What is an ERN?

The Employer Reference Number (ERN), also known as the Employer ‘Pay As You Earn’ (PAYE) reference, is a unique combination of letters and numbers that HMRC uses to identify your business when calculating tax for your employees. It is an important piece of information that you should hold on to once you have registered for PAYE for Employers.

From 1 April 2012, the capture of the ERN’s for your business and all subsidiary companies (if applicable), became mandatory for Insurers for new and renewed policies.

The ELD’s (Employers Liability Database) ability to provide enquirers with successful trace results is supported by establishing a unique identifier for employers. ELTO (Employers Liability Tracing Office) has adopted the ERN as the most effective unique identifier available.

Why your business needs an ERN?

The HMRC now includes the ERN when responding to employee requests for their employment history schedule, therefore enabling the claimant to use it to search the ELD.

The HMRC needs your ERN in a number of different circumstances. Perhaps most importantly, you will need it when you come to complete your end-of-year PAYE return. An invalid or missing ERN is one of the most common reasons end-of-year returns are rejected – you will need to know this number to meet your statutory reporting obligations.

What if I have lost my ERN?

It is important that you keep hold of your ERN, as you will need it regularly throughout the tax year. If you lose it, you will be able to find it on letters or emails about PAYE from HMRC. It will also appear on any P45s or P60s for previous or current employees.

If you do not have any record of your ERN, it may be that you are not registered as an employer. If this is the case, but you are employing or intend to employ someone, you should register as soon as possible.

Why do I need to give my ERN to my insurer?

The Employers’ Liability Tracing Office (ELTO) has set up a database to help employees identify their past employers’ insurers, making it easier to claim. You will therefore need your ERN when you buy Employers’ Liability insurance.

This is so that, in the event of an Employers Liability Claim, it is possible to identify which firms the claimant has worked for. Employers Liability insurance claims can occur long after the alleged actual event and the ELD allows for a simple search to be completed to see which firms might be liable under the claim.

Why is the ERN mandatory?

The FCA regulations were introduced in two phases, with EL policy data being required from 1 April 2011 and additional information including the ERN and subsidiary company information being required from 1 April 2012.

The ERN will be used as a unique reference which will enable claimants and their representatives to search more effectively for the Employers’ Liability insurer concerned. This will ensure that more claimants can find their insurer, particularly where their previous employer has ceased trading and there is no other point of reference.

Where to find the Employer Reference Number (ERN)?

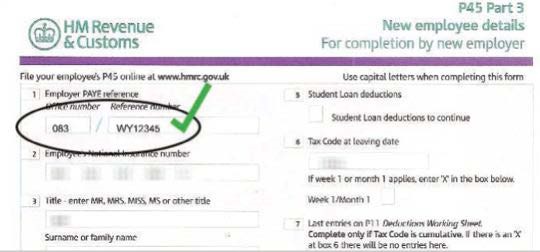

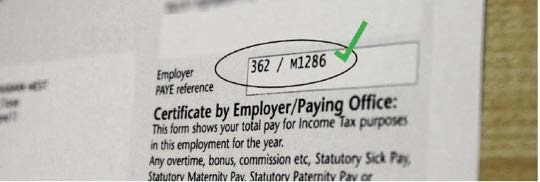

The ERN can be found on many documents including: P45, P60, P11/D and the Employer Payment Booklet. The ERN is collected as a unique identifier for the company concerned.

This reference is made up of two parts: a three-digit HMRC office number, and a reference number unique to your business. It will usually look something like 123/A45678 or 123/AB45678 (though there can be exceptions).

An example of an ERN format on a P45 form:

An ERN on an Employer Payment Booklet.

There are very few ERN exemptions.

In all cases where PAYE is operated, an ERN is allocated to the employer and the ERN applies to all UK businesses employing one or more people. A minority of employers do not have an ERN, including those that:

- Pay all employees below the current Lower Earnings Limit, none of the employees have another job, and none of the employees are in receipt of a state or occupational pension or other employee benefits. For more information on the threshold limits, please see the HMRC website (www.hmrc.gov.uk).

- Are registered in the Isle of Man, or the Channel Islands (these have no tax presence in the UK).

ERN vs Accounts Office reference

Please note the difference between an ERN and Accounts Office Reference.

| ERN – ex: 012/A123456 | Accounts Office Reference ex 012/PA12345678 |

|---|---|

| Is between 5 and 12 characters in length | Is between 13 or 17 characters in length* |

| Start with 3 numbers between 001 and 999 (representing the tax office) | characters 1-3 are numeric |

| Then “/” (forward slash character) | character 4 is always ‘P’ |

| 1 or 2 alpha characters | character 5 is an alpha character |

| From 1 up to 6 numeric characters | characters 6-12 are numeric |

| character 13 can be numeric or ‘X’ |

* Sometimes this is extended to 17 characters to include ‘YYMM’ at the end for payments made by an employer relating to a specific period

How could it benefit me?

Do not view the ERN as just another piece of paperwork/documentation that you need to obtain, there is a significant benefit to you. EL insurance is a legal requirement for most companies with employees. If you were to be faced with a claim, the ELTO can prove you had the insurance at the time you employed the claimant.

What is the mandatory information required?

All commercial lines EL policies, regardless of whether the business was written through a broker, scheme, or a delegated authority, must be supplied to the relevant insurer as soon as the information is available to allow the insurer to upload the details to the ELD within the regulatory timescale of 90 days.

Are changes made to ERNs?

No retrospective changes are made to an employer’s ERN after it is issued by the HMRC. Therefore, even if the employer is taken over, ceases trading or moves tax office, the ERN for a specific point of time is permanent.

What is the HMRC employment history schedule?

This is a list of an individual’s employers (past and present) with the dates of employment. This data is drawn from the National Insurance Contributions Office (NICO) database which is linked to the PAYE database. The HMRC now includes the ERN in its responses to employee requests for their employment schedule.

Some companies have more than one ERN – how is this being handled?

Multiple ERNs are only likely to be a feature of larger corporate companies. In these instances, brokers should provide details of all ERNs for an insured.

Where electronic trading platforms are being used, then only one ERN is capable of being captured.

In this case the ‘most relevant’ ERN should be provided; this being the one that covers the majority of the company’s employees.

Note: The ERN is not to be confused with HMRC’s Accounts Office Reference. The Accounts Office Reference Number is the reference used by an Employer when making payments to HMRC and is often mistaken for the Employer Reference Numbers. This is a common misunderstanding as the numbers are similar and often appear together on relevant documents such as the P45, P60, P11/D and on payslips. Both numbers usually begin with the same 3 digits representing the tax office whose catchment area the employer falls into

Latest Articles

Underinsurance Claims Scenario

You wouldn’t want to hear that your insurance won’t be enough to cover a claim. Businesses across the UK that are already struggling, thanks to surging inflation and its knock-on effect on

Underinsurance & what it means to your business

What is underinsurance? Your insurance premium is calculated based on your individual circumstances and the amount of cover you choose to take out to protect your business. Underinsurance occurs when you’ve not

Why consider Employment Practices Liability cover?

The complex nature of employment laws means that companies need to keep up to date with changes to legislation and regularly review and update internal procedures. For businesses of any size, employment

Business Interruption Insurance – A Brief Guide

Business interruption insurance (BI) provides cover for financial losses due to an interruption to a business caused by material damage to property. Cover is typically incorporated into a package or commercial combined