You wouldn’t want to hear that your insurance won’t be enough to cover a claim. Businesses across the UK that are already struggling, thanks to surging inflation and its knock-on effect on the cost of living, may not be able to survive the consequences of being underinsured.

Our insurance advisors regularly speak about this issue with clients, highlighting that many businesses across the country are likely to be seriously under protected in the event of a claim for damage. In the vast majority of these cases, this is due to underinsurance which means that when a claim is made, the pay-out for the damage can be severely reduced.

To understand the possible outcomes of Underinsurance read:

- Underinsurance claims scenario: Business Interruption

- Underinsurance. What does it mean for your business?

If you think your business might be underinsured, talk to a Darwin Clayton expert today, please call on 01892 511 144 or email info@dcuk.co.uk

Latest Articles

Carbon Reporting: What’s the impact?

Carbon reporting is becoming an increasingly important topic in the construction, building and facilities management industries, with many countries implementing laws and regulations aimed at reducing carbon emissions. Building services contractors are

Underinsurance & what it means to your business

What is underinsurance? Your insurance premium is calculated based on your individual circumstances and the amount of cover you choose to take out to protect your business. Underinsurance occurs when you’ve not

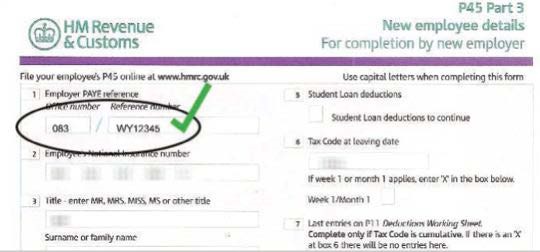

Employer Reference Numbers for ELTO requirements

What is an ERN? The Employer Reference Number (ERN), also known as the Employer ‘Pay As You Earn’ (PAYE) reference, is a unique combination of letters and numbers that HMRC uses to

Why consider Employment Practices Liability cover?

The complex nature of employment laws means that companies need to keep up to date with changes to legislation and regularly review and update internal procedures. For businesses of any size, employment