What is underinsurance?

Your insurance premium is calculated based on your individual circumstances and the amount of cover you choose to take out to protect your business. Underinsurance occurs when you’ve not taken out the right amount of insurance cover for your needs and there will be a variety of factors to take into account when you assess how much insurance you require.

Underinsurance has a significant impact on businesses, often causing business closure.

But why wouldn’t an insurer cover your full loss? What should you do and what should you take into consideration when arranging your business insurance?

To find out more about underinsurance and how to make sure your business has the correct cover, read our Underinsurance Explained Guide.

Latest Articles

Underinsurance Claims Scenario

You wouldn’t want to hear that your insurance won’t be enough to cover a claim. Businesses across the UK that are already struggling, thanks to surging inflation and its knock-on effect on

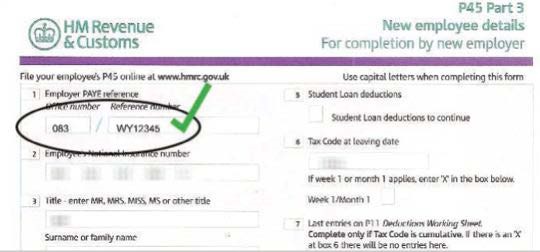

Employer Reference Numbers for ELTO requirements

What is an ERN? The Employer Reference Number (ERN), also known as the Employer ‘Pay As You Earn’ (PAYE) reference, is a unique combination of letters and numbers that HMRC uses to

Why consider Employment Practices Liability cover?

The complex nature of employment laws means that companies need to keep up to date with changes to legislation and regularly review and update internal procedures. For businesses of any size, employment

Business Interruption Insurance – A Brief Guide

Business interruption insurance (BI) provides cover for financial losses due to an interruption to a business caused by material damage to property. Cover is typically incorporated into a package or commercial combined