The complex nature of employment laws means that companies need to keep up to date with changes to legislation and regularly review and update internal procedures.

For businesses of any size, employment related claims represent a potentially damaging and negative exposure both financially and reputationally. The company may face claims from past, present or prospective employees as well as other individuals who benefit from workplace protections. These can include wrongful termination claims, breach of employment contract and claims arising from allegations of discrimination and harassment.

Most companies will have robust existing HR processes and resources in place, together with a Directors & Officers liability policy; however they may not have previously considered a need for additional Employment Practices Liability cover, which is typically offered as an extension to Directors & Officers Liability.

As businesses continually adapt to the COVID-19 trading environment and plan for the winding down of the Furlough scheme, this presents new risks and challenges to business operations and companies may find themselves exposed to potential claims. In terms of exposures for businesses, key questions include whether employers have sufficiently considered and implemented risk management for new working practices and communicated these effectively to staff and whether correct procedures have been followed in respect of staff redundancies.

What is the difference between Employment Practices Liability (EPL) and Directors & Officers Liability (D&O) insurance?

D&O liability policies provide insurance for negligent acts, omissions or misleading statements committed by directors and officers of a company that result in lawsuits being filed against the company. D&O coverage can be purchased to reimburse the company when it indemnifies directors or officers, to specifically cover those individuals when the company doesn’t indemnify them or can provide entity coverage to cover claims made specifically against the company.

Although somewhat different, many confuse EPL with D&O insurance. EPL provides some protection for employers from claims made by workers who have sued the company for violating their legal rights as employees. Possible lawsuits include claims for sexual harassment, breach of employment contract, wrongful termination, discrimination and failure to hire or promote

Companies and their directors and officers should be mindful of the claims that may arise from the management of these risks, and note how their insurance policies may respond to provide protection.

Please do not hesitate to get in touch with your usual Darwin Clayton representative if you would like to discuss the options available.

Latest Articles

Underinsurance Claims Scenario

You wouldn’t want to hear that your insurance won’t be enough to cover a claim. Businesses across the UK that are already struggling, thanks to surging inflation and its knock-on effect on

Underinsurance & what it means to your business

What is underinsurance? Your insurance premium is calculated based on your individual circumstances and the amount of cover you choose to take out to protect your business. Underinsurance occurs when you’ve not

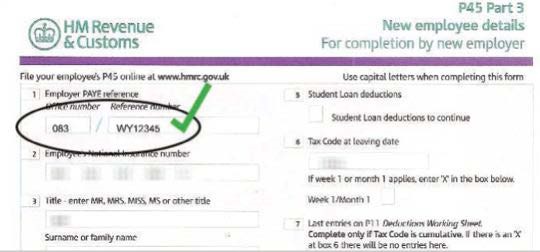

Employer Reference Numbers for ELTO requirements

What is an ERN? The Employer Reference Number (ERN), also known as the Employer ‘Pay As You Earn’ (PAYE) reference, is a unique combination of letters and numbers that HMRC uses to

Business Interruption Insurance – A Brief Guide

Business interruption insurance (BI) provides cover for financial losses due to an interruption to a business caused by material damage to property. Cover is typically incorporated into a package or commercial combined